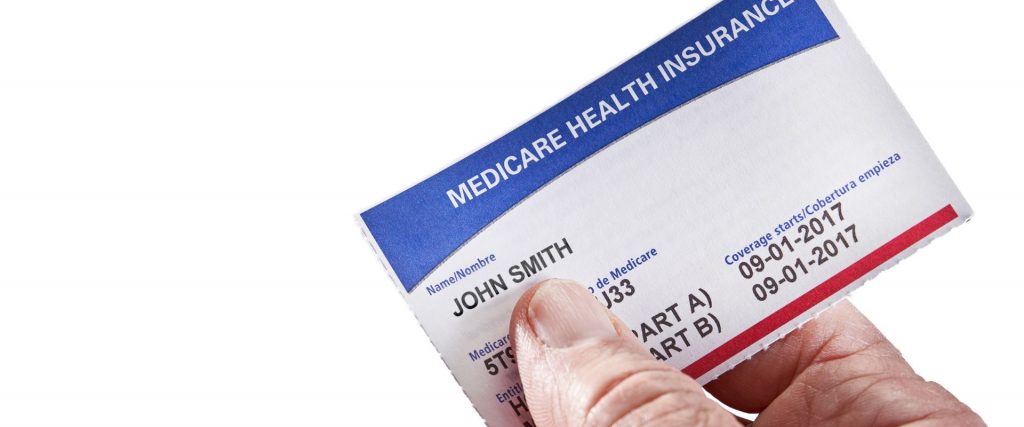

Medicare beneficiaries get blue, white, and red Medicare cards when enrolling in Original Medicare which consists of PartA (hospital insurance) and Part B (medical insurance). This card is your primary document when you go seek services and care that are covered by Medicare because it is only proof that you have this type of coverage. This card has it is own number that is specific and unique for each Medicare beneficiary. It is not the same as your Social Security Number. You will be automatically enrolled in Parts A and B if you are receiving Social Security or Railroad Retirement benefits. Therefore, you will receive this card at your address when first eligible- which is three months before you turn 65. However, if you are eligible for Medicare coverage due to disability, which means that you receive Social Security Disability Insurance for at least 24 months you will get your card a month later.

If you are not receiving Social Security benefits or Railroad Retirement Benefits you will not be automatically enrolled in Parts A and B. This means that you need to apply by yourself to get a Medicare card and coverage. You can enroll during Initial Enrollment Period which is a 7-month open window and begins three months before your 65th birthday, the month you are 65, and 3 months after you turn 65. When your application is approved, you’ll get your card a month later.

Do I Always Have To Use My Medicare Card?

If you are seeing a new doctor or healthcare provider, it is very likely that he or she will want to see your Medicare card. This is especially true if you are receiving treatment for chronic conditions such as diabetes, heart disease, cancer, etc. This is because your Medicare card contains information about your medical history and current medications, including what prescriptions you take. Your doctor needs access to this information to ensure what is the best treatment for your condition.

Also, doctors usually keep copies of your Medicare card in their office files, but they often ask you to bring your card with you to appointments. So, bring your Medicare card with you to every appointment which also includes routine checkups, annual physical exams, visits with specialists, hospital stays, and emergency room services. Be aware that Medicare covers only 80% of medical services, which means that the other 20% of the costs is beneficiaries obligation.

What If I Lose My Medicare Card?

It always can happen that we lose our important documents so if you were ever wondering have to request a replacement for your Medicare card if you lost it, keep reading. You can replace your lost, stolen, or damaged card through Social Security Office or Railroad Retirement Board. You can also do it online for free by using your My Social Security Account. If you don’t have this account or don’t want to use it, you can always replace it by calling or visiting the office. However, if you are requesting your card through Railroad Retirement Board you need to call or visit the office to report the lost item.

After your request is filed, it will be sent to your last known living address through the mail so if you recently moved call the offices to make an update on your address or do it online.

What If I Need My Card Sooner Than 30 Days?

If you have some unpredicted circumstances and need your new Medicare care sooner than 30 days you can ask your Social Security or Railroad Retirement Board to give you temporary proof that you receive Medicare coverage. This proof can be mailed to your address approximately ten days after your request. If you don’t have time to wait. you can get this proof immediately by going down to the offices (SSO or RRB) in person.

How To Protect My Medicare Card?

You may worry that bringing your Medicare card could put your privacy at risk. However, there are some safeguards in place to protect your personal information. For example, your Medicare number is generally not written anywhere on your card. And your card does not contain enough identifying information to allow someone else to use it without your permission.

Medicare does not want you to give out personal information over the phone unless it’s absolutely necessary. Medicare providers don’t even want you to share out personal information over email. If someone asks you for personal information, don’t answer questions you don’t understand or aren’t sure are allowed.

If you do give out personal information, make sure you know what you’re doing. For example, if you give out your Social Security number, Medicare won’t pay for anything related to your taxes, including filing a tax return. You could also end up paying more for medical bills because your doctor might think you’re uninsured and charge you more. This is especially important if you have Medicare Savings Program.

However, there are some exceptions where it makes sense to share your Medicare number with someone else. There are several examples when you can tell your doctor, nurse practitioner, or physician about your Medicare number. Those specific cases are:

- You want to enroll in a plan offered by your provider

- You’re planning to switch doctors or medical practices

- You’ve been diagnosed with a serious illness or injury: for example, if you receive treatment for a chronic condition, such as diabetes or hypertension, you’ll likely have to fill prescriptions for medications covered under Medicare Part D (drug prescription coverage)